how to pay indiana state taxes quarterly

Find Indiana tax forms. Paying State Income Tax in Arkansas.

Tax Penalties Here S What To Do If You Can T Pay Your Taxes This Year Abc7 Chicago

The tax year for 2021 is.

. How to Pay Quarterly Taxes. Estimated payments may also be made online through Indianas INTIME website. Paying State Income Tax in Alabama.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax.

Start 30-Day Free Trial. On the first screen select Estimated Tax as the reason for payment 1040ES as the Apply field and the year you are making the payment for. Quarter 1 Jan-Mar due Apr.

Up to 25 cash back You must file a WH-1 for every payment period even if no tax was withheld. As a self-employed person if you wish to avoid getting fined for underpayment of estimated taxes then youll want to file and pay by their due date. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one.

Line I This is your estimated tax installment payment. Some states also require estimated quarterly taxes. 20 Quarter 3 Jul-Sept due Oct.

Paying State Income Tax in Arizona. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

Ad Save Time Editing Signing Filling PDF Documents Online. State Agency List. Paying Quarterly Taxes by State.

In Indiana UI tax reports also known as premium reports and payments are due on or before the last day of. Know when I will receive my tax refund. SBAgovs Business Licenses and.

Pay my tax bill in installments. 20 Quarter 4 Oct-Dec due. As an employer you must match this tax dollar-for.

Do this even if you have a single-member LLC set. When paying quarterly taxes the easiest way to go about it is to pay 100 of the amount you paid in income tax from the previous year. We last updated the Estimated.

This means you may. The tax bill is a penalty for not making proper estimated tax payments. For help calculating how much tax to withhold check the DORs Departmental Notice.

Claim a gambling loss on my Indiana return. Form WH-1 Withholding Tax Voucher for EFT Early Filer. Indiana Small Business Development Center.

Send in a payment by the due date with. Up to 25 cash back File Quarterly UI Tax Reports and Payments. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one.

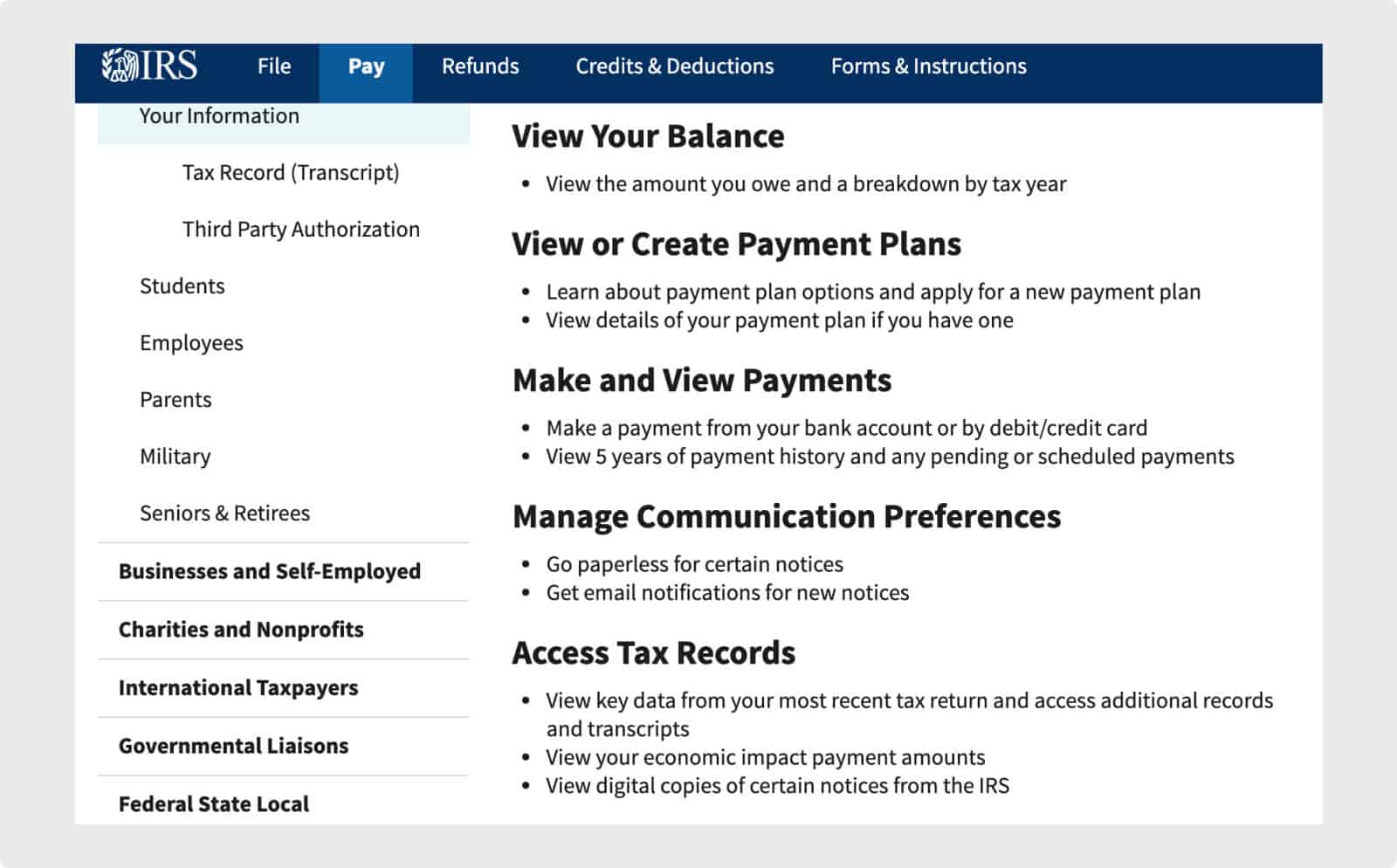

Simply take the total amount you paid. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Make a payment online with INTIME by electronic check bankACH - no.

Online PDF Editor Sign Platform Data Collection Form Builder Solution. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Take the renters deduction.

Find Indiana tax forms. 20 Quarter 2 Apr-Jun due Jul. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source.

Lines J K and L If you are paying only the. Know when I will receive my tax refund. You can find your amount due and pay online using the intimedoringov electronic payment system.

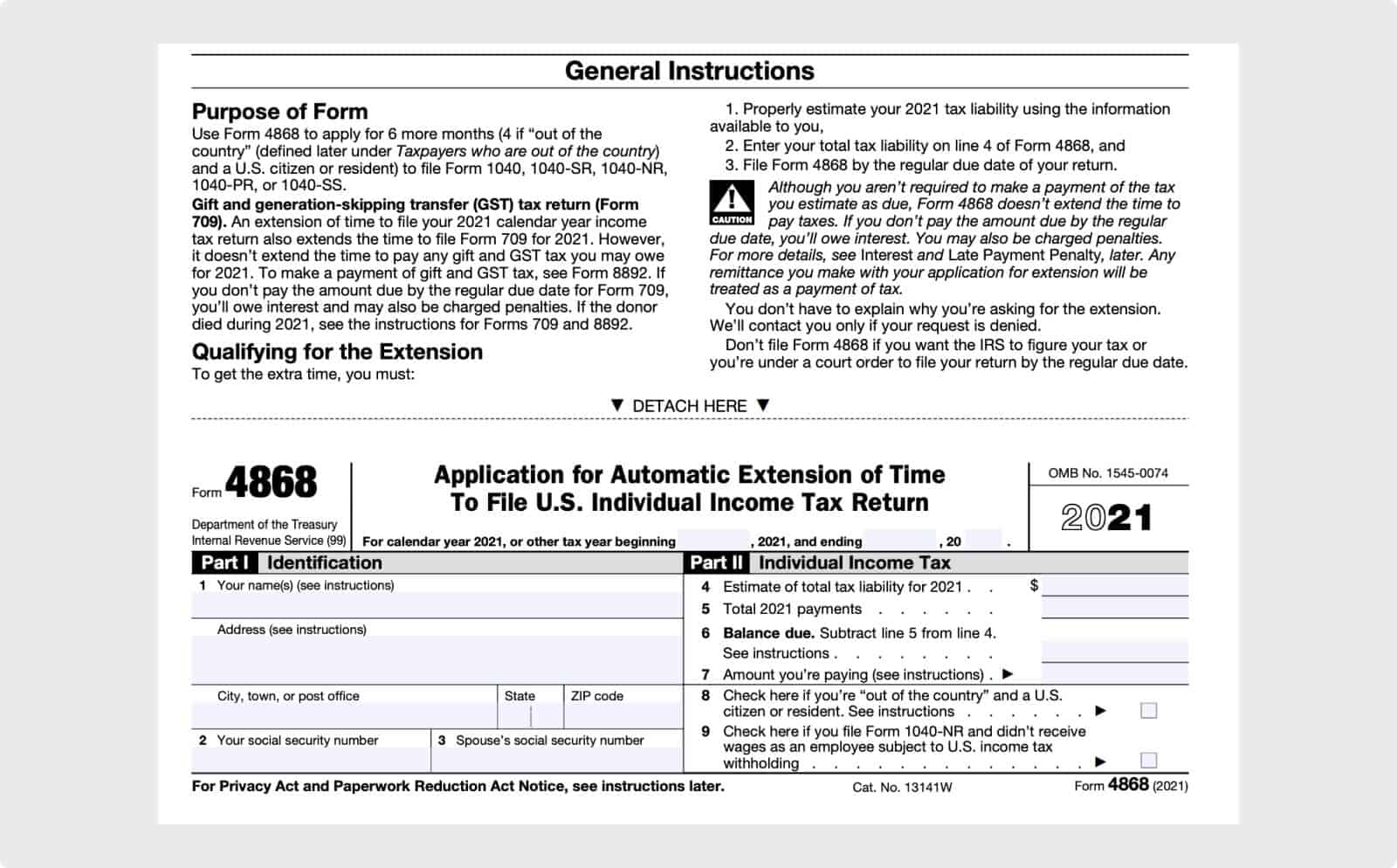

So if you discover youre required to pay quarterly taxes you must first use Schedule C of Form 1040 to determine how much you owe. The state income tax rate is 323. Have more time to file my taxes and I think I will owe the Department.

Take the renters deduction. Paying State Income Tax in California. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

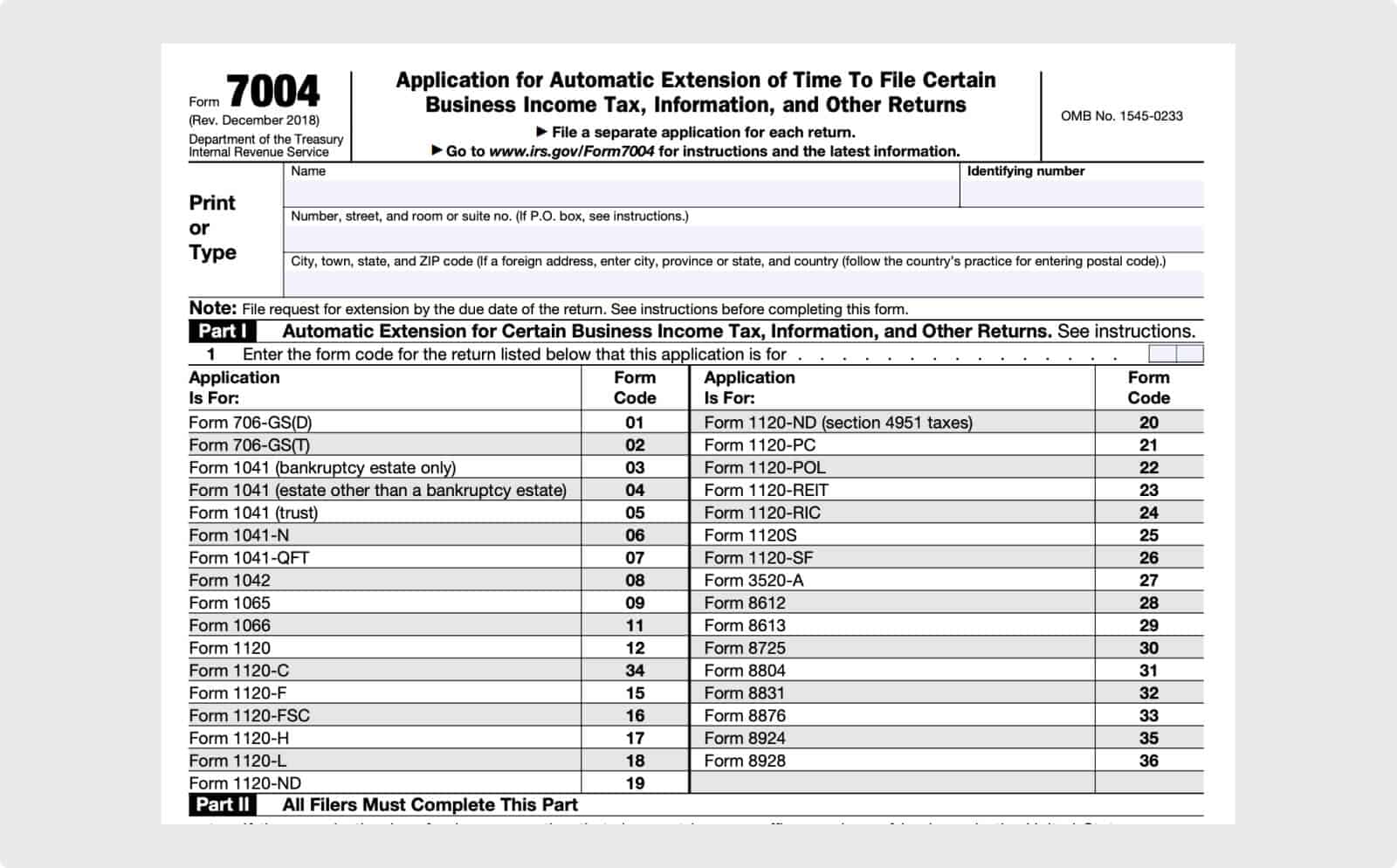

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Forms required to be filed for Indiana payroll are. What are the payroll tax filing requirements.

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Department of Administration - Procurement Division. If you file quarterly your payment schedule is as follows.

The Complete List Of Tax Deadlines For Small Businesses Simplifyllc

Limited Liability Company Llc Colorado Secretary States

Self Employed Taxpayers How To Avoid A Large Irs Bill Ils

The Complete List Of Tax Deadlines For Small Businesses Simplifyllc

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Indiana Sales Tax Small Business Guide Truic

Quarterly Tax Calculator Calculate Estimated Taxes

1099 Etc Voted Best In 1099 W 2 Compliance And 2 In Payroll In Cpa Practice Advisor 2014 Reader Poll Welcome To 1099 Payroll Taxes Payroll Software Payroll

Cryptocurrency Taxes What To Know For 2021 Money

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

2022 Federal Payroll Tax Rates Abacus Payroll

The Complete List Of Tax Deadlines For Small Businesses Simplifyllc

Indiana County Income Taxes Accupay Tax And Payroll Services